- Where to buy crypto

- Crypto wallet app

- Cryptocurrency to buy

- Apps cryptocurrency

- Is mining crypto worth it

- Cryptocurrency dogecoin price

- Cryptocom login

- Cryptocom gas fees

- What is metaverse crypto

- Brand new crypto

- Bitcoin trend

- Bitcoin converter

- New crypto to buy

- Celsius currency

- Btc mining

- Crypto deposits

- Crypto mining

- Bitcoin to doge exchange

- How much is bitcoin today

- Moon currency

- Where to buy bitcoin

- Eth max price

- Will ethereum crash

- Cryptocurrency software

- Shibusd crypto

- Will dogecoin be on coinbase

- Solana crypto price

- How to trade cryptocurrency

- Crypto graph

- Polygon crypto

- Is crypto com down

- How much is bitcoin worth in us dollars

- When did btc come out

- Staking crypto

- Btc value usd

- Crypto price index

- What is btc wallet

- Who own bitcoin

- How to use crypto

- Crypto pay

- Can you buy crypto with a credit card

- Top cryptos

- What app can i buy dogecoin

- Buy bitcoin cash app

- Buy crypto with credit card

- Bitcoin cryptocurrency

- Cryptocom dogecoin

- What is crypto

- Nft crypto coins

- When could you first buy bitcoin

- Cryptocom taxes

- Crypto exchange

- Doge crypto

- Selling crypto

- Cryptocurrency exchanges

- Best crypto to buy

- Crypto market live

- Bitcoin apps

- Why buy bitcoin

- How to buy on cryptocom

- Btt crypto price

- Btc prices

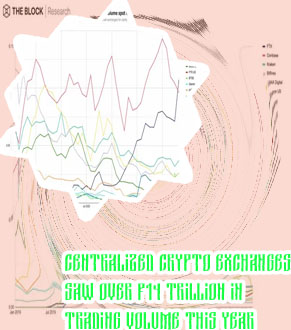

Centralized crypto exchanges saw trillion volume

How to buy Bitcoin in New Zealand

Centralized crypto exchanges have been experiencing a surge in trading volume, reaching trillions in recent months. This has led to both excitement and concern within the crypto community as traders navigate the risks and opportunities associated with these platforms. To help shed light on this topic, here are 2 articles that provide insights and solutions for addressing the challenges posed by the soaring trading volume on centralized exchanges:

As centralized crypto exchanges continue to see trillions in trading volume, it is crucial for investors to stay informed on the latest trends and developments in the industry. Below are two articles that provide valuable insights and strategies for navigating this fast-paced market:

Maximizing Profits on Centralized Crypto Exchanges: Tips and Tricks for Traders

Centralized cryptocurrency exchanges have become popular platforms for traders looking to maximize their profits. These exchanges offer a wide range of trading pairs, high liquidity, and user-friendly interfaces that make it easy for both beginners and experienced traders to buy and sell digital assets. However, in order to truly maximize profits on these exchanges, traders need to employ certain tips and tricks that can help them stay ahead of the competition.

-

Take Advantage of Trading Pairs: Centralized exchanges offer a variety of trading pairs, allowing traders to diversify their portfolios and take advantage of price discrepancies between different assets.

-

Use Limit Orders: By using limit orders instead of market orders, traders can set the price at which they are willing to buy or sell an asset, ensuring that they get the best possible price for their trades.

-

Keep an Eye on Market Trends: Staying informed about market trends and news can help traders make informed decisions about when to buy or sell their assets, increasing their chances of maximizing profits.

-

Utilize Stop-Loss Orders: Setting stop-loss orders can help traders minimize their losses in case the market moves against them, allowing them to protect their profits and limit their risks.

-

Practice Risk Management: It is important for traders to only invest what they can afford to

The Rise of Decentralized Exchanges: How They Are Disrupting the Centralized Exchange Model

none